Frequently asked questionsĪ long-term car loan means a lower monthly payment. Otherwise, you could be left in a tough financial spot, potentially without a vehicle.īut if you keep your budget in mind, arrange for autopay, aim for an early payoff, consider refinancing if needed and communicate openly with your lender, the vehicle will be all yours in no time. Taking the right steps in managing your auto loan ensures that the vehicle will be yours once the loan is paid off. Remember, if trouble arises, the key is to reach out sooner rather than later. If you, for example, think you might miss a payment, the door has already been opened for support. Refinancing involves getting a new loan, potentially with a new interest rate or term length, and using it to repay your old loan. If you struggle to make your auto payments - or if making regular payments has helped your credit score improve - refinancing can help you get better rates and terms. If there’s a prepayment penalty, ensure your savings would outweigh it. Also, confirm that your lender does not enforce any fees for early repayment.

#CAR LOAN CALC BANKRATE FREE#

Or use the sudden influx of funds to pay off your highest-interest debt, which can free up money to aggressively pay down your auto loan.īut before making this choice, use an early payoff calculator to determine if it’s the right move. Try making extra or larger payments or applying tax refunds to the principal.Īlso, if you experience an unexpected financial windfall, consider using the money to repay your auto loan ahead of time. Plus, you will pay less interest over the loan’s lifetime. Work toward early repaymentĮarly repayment means that the vehicle can become yours sooner. Remember that some bank-funded auto loans require a checking account with the same financial institution if you want to use autopay. Simply reach out to your lender to add your bank account information. Some even boast additional discounts of 0.25 percent to 0.5 percent for using autopay. Set up autopayĪrranging automatic payments each month on your auto loan is an excellent way to protect against accidentally missing payments and falling behind. If this number does not fit your spending, consider cutting back in other categories. Now that payments have begun, you can gauge how they fit into other finances.Įdmunds advises that a new car payment should be no more than 15 percent of your take-home pay - 10 percent for a used car. While you have already crunched the numbers to secure the right auto loan, you must keep your budget in mind. Consider the following steps after getting an auto loan.

Instead, you must take important steps to manage your auto loan to ensure the vehicle remains yours.

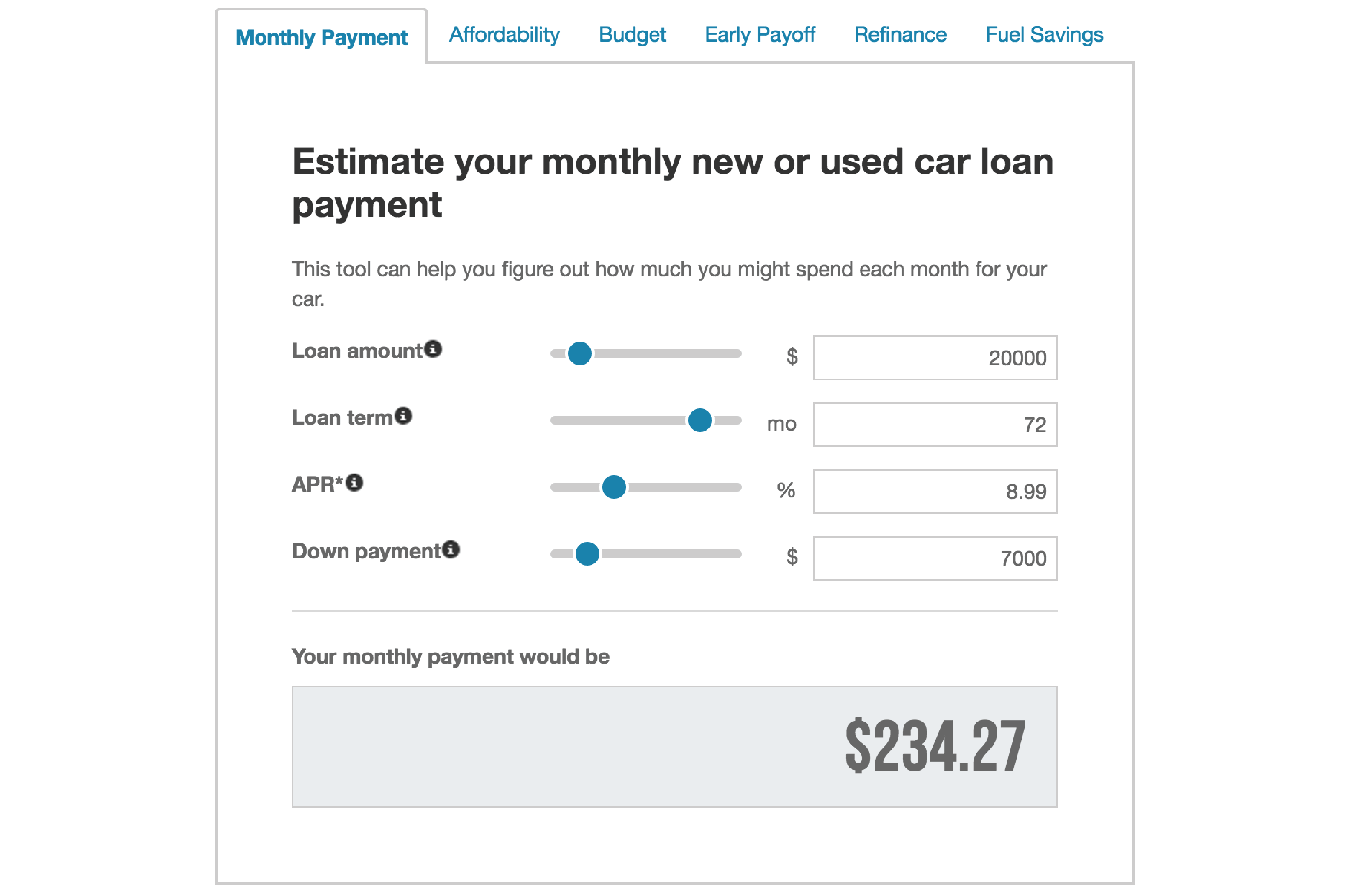

Our online application service is FREE and available for all.Your work isn’t over after you exit the dealership lot behind the wheel of your new vehicle. Keep changing the fields until you see a package you like, and then click on the best car loan for you by clicking on the Apply Now button to sign up. By clicking on "fixed rate" or "variable rate" tabs below the calculator, you can switch between the two major categories of car loans. Upon completion, the online car loan calculator in Malaysia would generate a list of available car loan packages fitting your requirements, starting with the ones with the best rates at the top. To use our online calculator, simply choose the make and model of your car then drag or key in your preferred loan amount and loan period at the top of this page. Generally, it is a good idea to make comparisons between several lenders before signing up for a car loan, and the easiest way to do so is using iMoney's online car loan calculator. In Malaysia, car loan interest rates differ based on several criteria, which notably include the make and model of the car, the age of the car (new or second-hand), the financial standing of the borrower, the loan amount, the repayment period as well as the entity providing the loan.

0 kommentar(er)

0 kommentar(er)